Introduction

An article by Tim Newton – Audit and Assurance Services in Oxford

The Financial Reporting Council (FRC) is in the process of updating FRS 102, the cornerstone of UK GAAP, as part of its periodic review. Among the most significant proposed changes is a major overhaul of lease accounting, particularly for lessees. This shift is set to align FRS 102 more closely with international accounting standards, which has already been adopted globally by many organisations.

These changes are expected to have a substantial impact on the financial reporting landscape in the UK, particularly for businesses with large lease commitments, such as retailers, manufacturers, and transportation firms. In this article, we explore the details of these upcoming changes, their likely impact, and what companies can do to prepare.

Current Treatment of Leases under FRS 102

Under the existing version of FRS 102, leases are classified as either finance leases or operating leases.

- Finance leases: These leases transfer substantially all risks and rewards of ownership to the lessee. Finance leases are recognised on the lessee’s balance sheet, with an asset and corresponding liability.

- Operating leases: These leases do not transfer significant risks or rewards. Payments under operating leases are treated as an expense on a straight-line basis over the lease term, with no balance sheet recognition.

This dual model, while simple in practice, has faced criticism for lacking transparency. It allows significant lease liabilities to remain off-balance sheet, potentially obscuring the financial obligations of businesses.

1. On-Balance Sheet Recognition of Leases for Lessees

The most notable change in the proposed amendments to FRS 102 is the removal of the operating lease classification for lessees.

Under the new model, lessees will recognise nearly all leases on the balance sheet. This approach requires:

- Right-of-Use (ROU) Asset: Representing the lessee’s right to use the leased asset over the lease term.

- Lease Liability: Representing the obligation to make lease payments.

“The lease liability is measured as the present value of future lease payments, discounted using the lessee’s incremental borrowing rate or the lessee’s obtainable borrowing rate.”

The ROU asset is initially measured at the amount of the lease liability plus any direct costs and restoration obligations.

2. Simplified Model, But More Complex in Practice

Though presented as a “single lessee accounting model,” this change will introduce more complexity into lease accounting, requiring significant judgement in determining:

- Lease term (including renewal options).

- Discount rates.

- Variable lease payments.

- Index-linked adjustments.

3. Exemptions for Short-Term and Low-Value Leases

Consistent with IFRS 16, the FRC has proposed certain practical expedients:

- Short-term leases: Leases with a term of 12 months or less.

- Low-value leases: Leases of assets that are low in value when new (e.g., small IT equipment or furniture).

These leases may continue to be treated as operating leases, allowing lessees to recognise lease payments as an expense over the lease term, keeping them off the balance sheet.

Impacts of the Proposed Changes

1. Impact on Financial Statements

Businesses with significant lease obligations will see a substantial increase in reported assets and liabilities. The profit and loss impact will also change, as lease expenses under operating leases will be replaced by:

- Depreciation on the ROU asset.

- Interest expense on the lease liability.

This change tends to “front-load” expenses because the interest portion is higher in the earlier years of a lease.

2. Effects on Key Financial Ratios

The amendments will affect several key metrics:

- EBITDA: Likely to increase, as lease expenses will be replaced with depreciation and interest below EBITDA.

- Gearing Ratios: Increased liabilities may result in higher debt-to-equity ratios.

- Return on Assets (ROA): The increase in total assets may reduce ROA.

Lenders, investors, and credit rating agencies will need to reassess covenant compliance and risk profiles under the new rules.

3. Industries Most Affected

Industries reliant on leased assets will be most impacted, including:

- Retail chains with numerous leased store locations.

- Logistics firms with leased warehouses and vehicles.

- Airlines and transportation providers.

- Hospitality businesses leasing properties or equipment.

Enhanced Disclosure Requirements

In addition to balance sheet changes, the proposals include more extensive disclosure obligations. Lessees will be required to provide:

- Breakdown of lease liabilities by maturity.

- Information about lease terms, renewal options, and termination clauses.

- Details on variable lease payments.

- Judgments made in determining lease terms and discount rates.

These disclosures aim to give stakeholders a better understanding of a business’s leasing activities and future cash flow obligations.

Transition and Implementation Considerations

1. Transition Accounting

When a company first applies the new lease accounting rules it should not restate comparative information. Instead, it should recognise the cumulative effect of the amendments as an adjustment to the opening balance of retained earnings (or other component of equity, as appropriate) at the date of initial application.

For each lease previously classified as an operating lease, the company shall:

a) recognise a lease liability at the date of initial application. The lease liability is the present value of the remaining lease payments, discounted using the lessee’s incremental borrowing rate or lessee’s obtainable borrowing rate for each lease at the date of initial application.

b) recognise a right-of-use asset at the date of initial application. The lessee shall measure that right-of-use asset at an amount equal to the lease liability, adjusted by the amount of any prepaid or accrued lease payments relating to that lease recognised in the statement of financial position immediately before the date of initial application.

2. System and Process Implications

Implementation of the new lease accounting rules will require:

- Comprehensive lease data gathering.

- Updates to accounting and ERP systems.

- Training of finance teams on the new requirements.

Some businesses may also need to renegotiate loan covenants or re-evaluate leasing strategies in light of the accounting changes.

Timeline and Effective Date

Proposed Timeline:

- Effective Date: Periods beginning on or after 1 January 2026 (subject to confirmation).

- Early adoption is permitted.

Businesses are encouraged to begin preparations well in advance, given the potentially significant changes required to systems, controls, and reporting processes.

Practical Steps for Businesses

- Perform a Lease Inventory Review

- Assess Financial Impact

- Prepare Systems and Processes

- Engage Stakeholders Early

- Consider Lease Strategy

Conclusion

The upcoming changes to lease accounting under FRS 102 represent one of the most significant shifts in UK GAAP in recent years. By moving to a model that places most leases on the balance sheet, the new rules will greatly enhance transparency but also increase complexity in accounting processes.

Businesses need to act now to prepare for these changes. Early planning, system updates, and proactive engagement with stakeholders will be key to ensuring a smooth transition and minimising disruption when the new standards take effect.

Practical Example: Lease Accounting under Revised FRS 102

Scenario:

- A business (lessee) enters into a 5-year lease for office space on 1 January 2026.

- Annual lease payments: £50,000, payable at the end of each year.

- No purchase option or variable lease payments.

- No initial direct costs or restoration obligations.

- Discount rate (lessee’s incremental borrowing rate): 5% per annum.

- The lease qualifies for on-balance sheet recognition under the new FRS 102 (i.e., it’s not short-term or low-value).

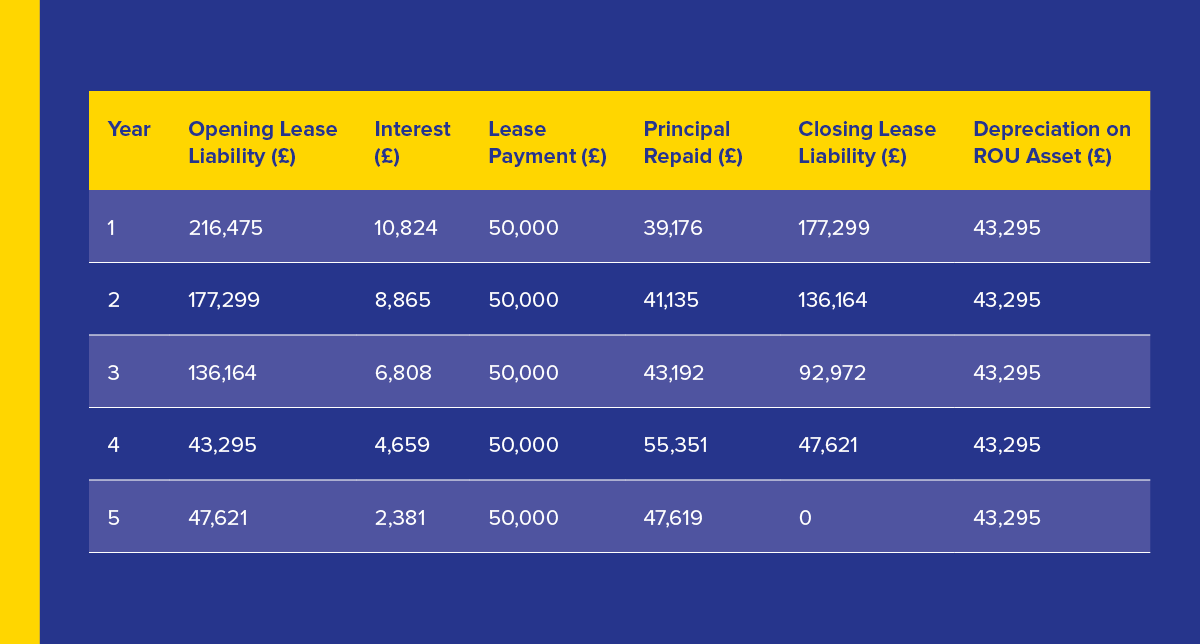

Step 1: Calculate the Lease Liability

The lease liability is the present value of future lease payments. We discount £50,000 annually for 5 years at 5%:

Lease Liability=£50,000×1−(1+0.05)−50.05\text{Lease Liability} = £50,000 \times \frac{1 – (1 + 0.05)^{-5}}{0.05} Lease Liability=£50,000×4.3295=£216,475\text{Lease Liability} = £50,000 \times 4.3295 = £216,475

Step 2: Recognise the Right-of-Use (ROU) Asset

Initial ROU Asset:

- Equal to the initial lease liability: £216,475.

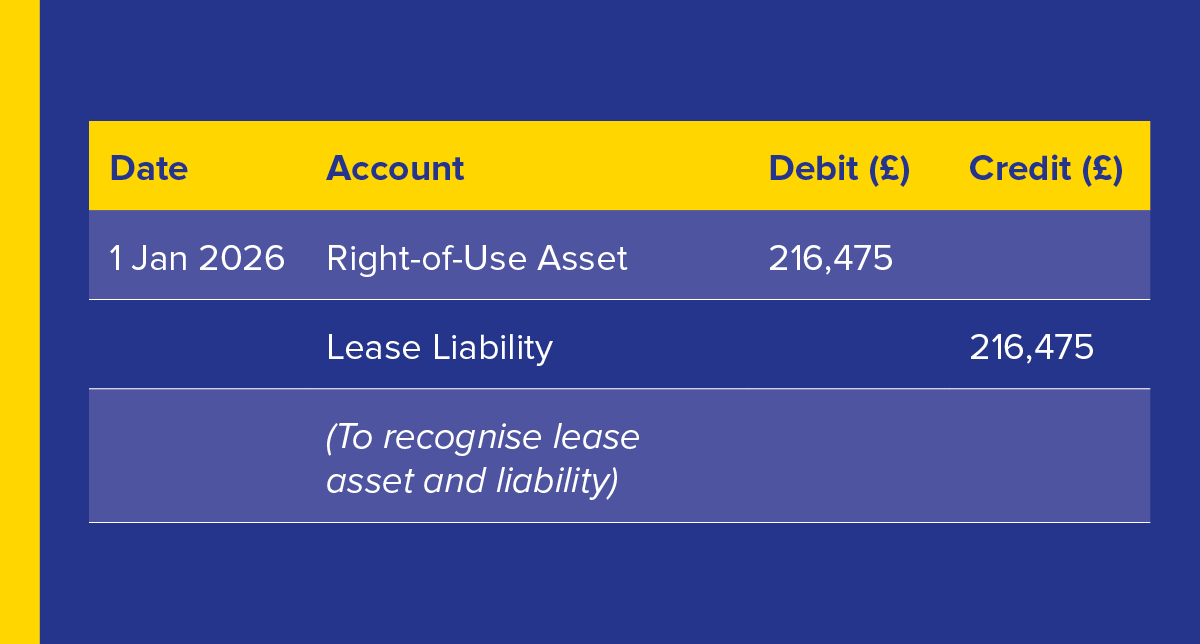

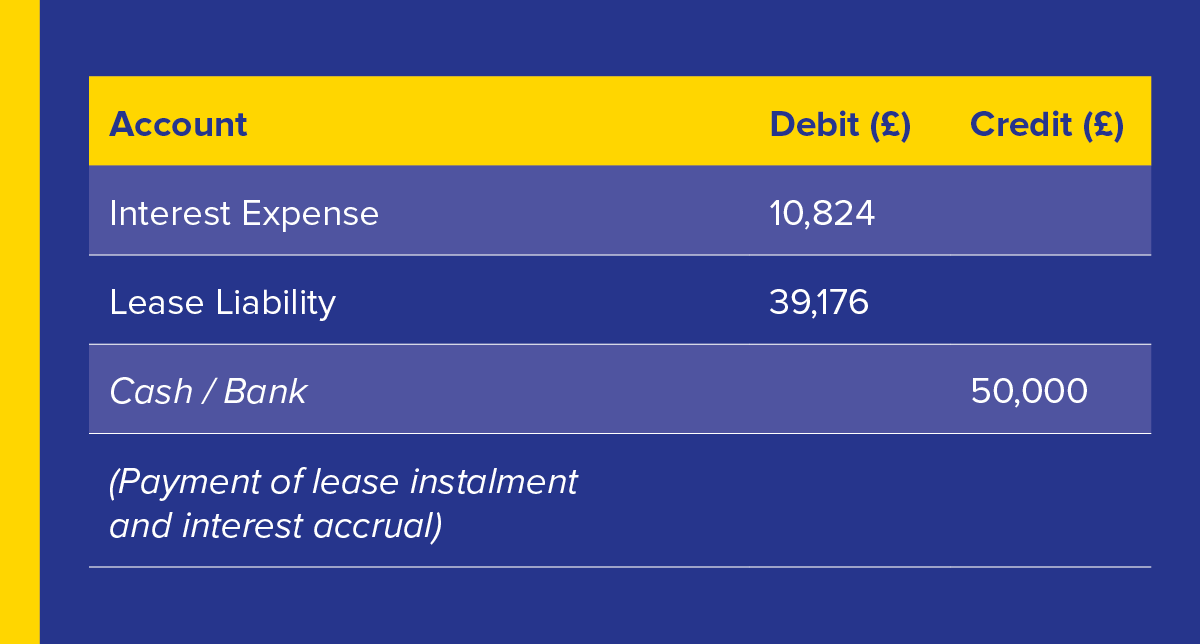

Step 3: Initial Journal Entry (at Lease Commencement)

Step 4: Subsequent Accounting (End of Year 1)

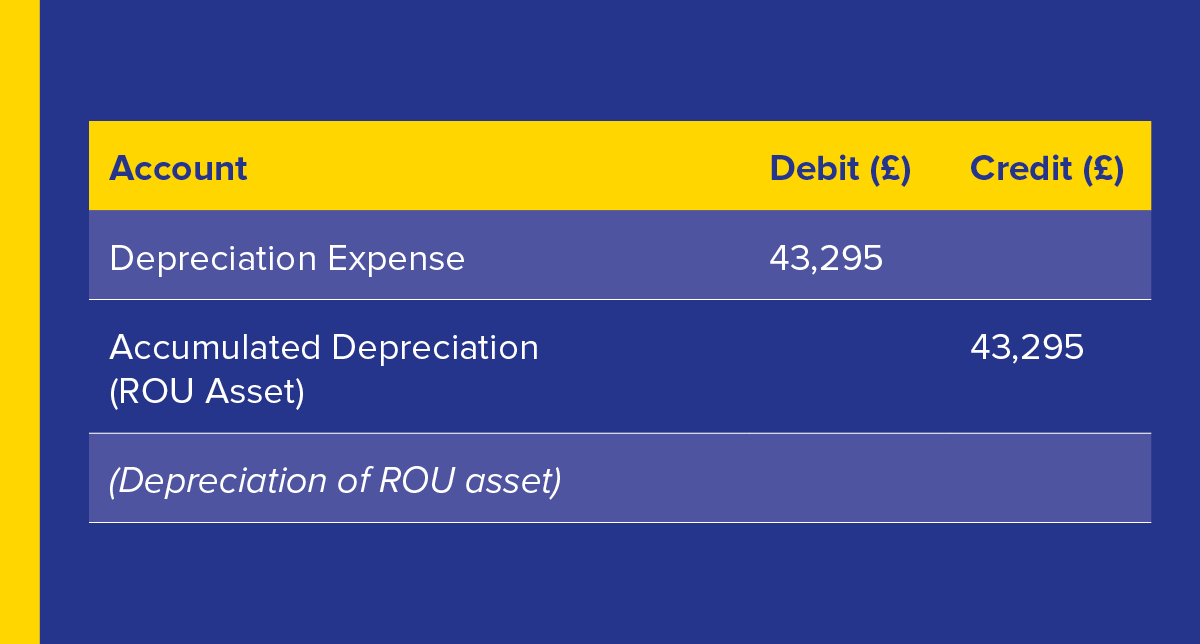

a) Interest on Lease Liability:

£216,475 × 5% = £10,824.

b) Lease Payment:

£50,000 paid at year-end.

c) Reduction in Lease Liability:

£50,000 (payment) − £10,824 (interest) = £39,176 reduction.

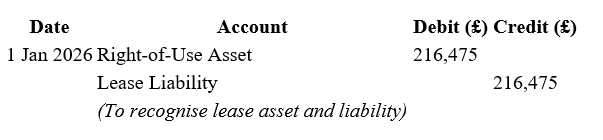

d) Depreciation on ROU Asset:

Depreciate ROU Asset on a straight-line basis over 5 years: £216,475 ÷ 5 = £43,295 per year.

Year-End Journal Entries (31 Dec 2026):

Depreciation:

Interest Expense and Lease Payment:

Step 5: Lease Liability at Year-End

Initial Lease Liability: £216,475

Less Principal Repaid: £39,176

Remaining Lease Liability: £177,299

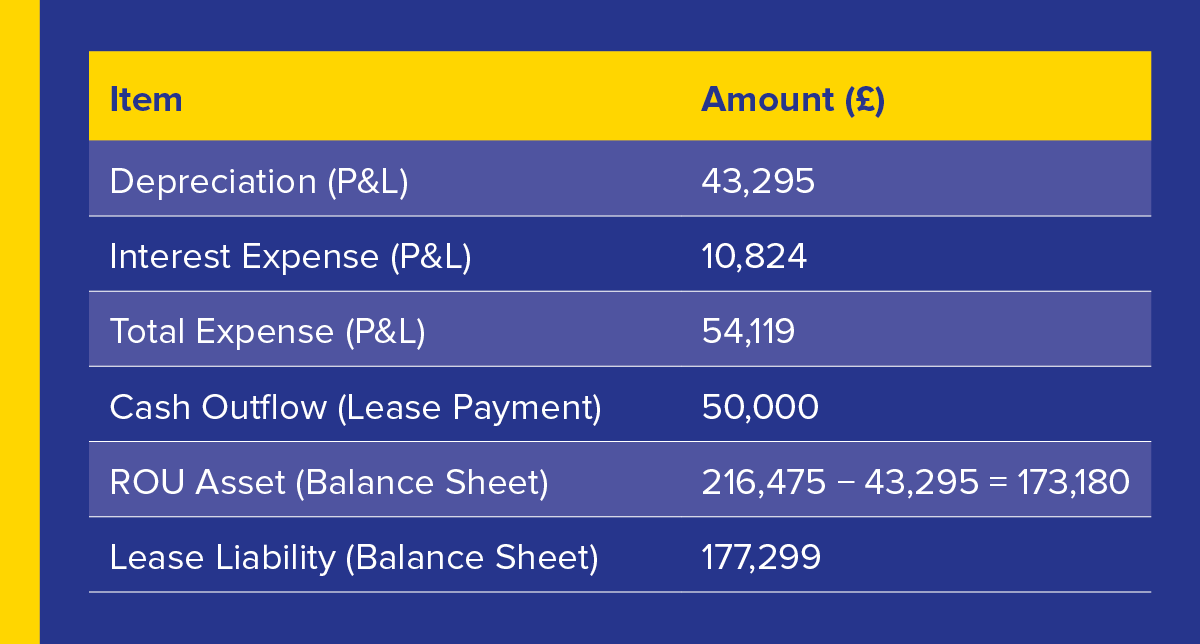

Summary of Impact (Year 1):

Lease Example Summary (5-year Lease, £50,000 Annual Payment, 5% Discount Rate)

Key Observations:

- Higher expense in initial years (due to interest), reducing over time.

- EBITDA improves (as depreciation and interest are shown separately from operating expenses).

- Increased assets and liabilities on the balance sheet.

➕ How This Differs From Current FRS 102 Treatment

Under current FRS 102 rules (before the proposed change):

- This lease would likely be classified as an operating lease.

- The business would simply expense £50,000 annually to profit or loss.

- No balance sheet recognition of the lease.

Result: Current approach → Simpler but less transparent. Proposed approach → More complex but more reflective of actual obligations.

➡️ Key Lessons from This Example:

- Lessees must prepare for more detailed lease data gathering and calculations.

- Impact on financial results and balance sheets can be significant.

- Careful planning is required to explain impacts to stakeholders, lenders, and investors.

The MGroup Accountants Oxford