One of the challenges that business owners face is how to plan for a successful exit. Whether it is a transfer of ownership to a family member, a management buyout, or the sale of the business to a trade buyer, the process requires careful consideration well in advance. In this article corporate finance specialist Geoff Pinder explains the basics of business exit planning and the key actions business owners must consider.

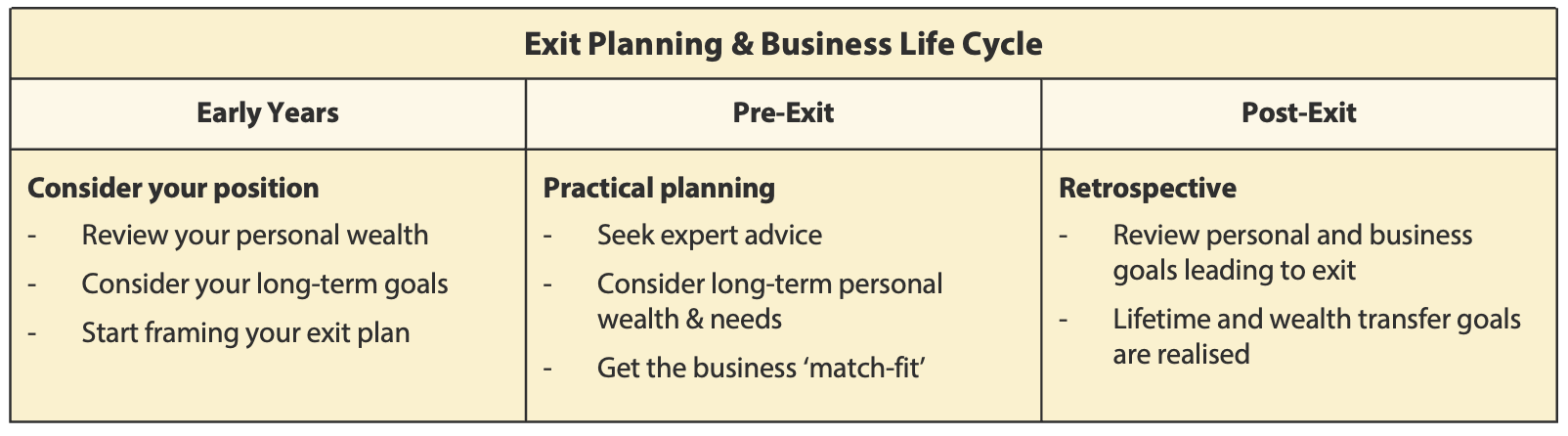

Planning can start from years before a sale and extends to the weeks and months post-exit. The key stages of exit planning can be defined within a business life cycle.

From the early years stage, business owners should consider their exit strategy as part of long-term growth plans and overall vision for the business. Initial thoughts around personal wealth, possible successors, and the best-case scenario for exit set an important benchmark for the future.

It is never too early to seek advice and bounce ideas around with trusted business partners as there are many options to consider, each with their own complexities. A corporate finance specialist with experience in exit planning will be able to explain all the possible options available and give advice about which are best for a particular business as well as the next steps to take.

Planning Pre-Exit

Exit planning should ramp up during the mid-stage years of business when owners have a clearer vision for the future, both personally and professionally. Putting a framework in place for exit at this stage will provide time to improves areas of the business that are key value drivers to a potential buyer or prepare the business for handover to an existing management team.

Planning Post-Exit

The exit planning process doesn’t stop as soon as the handover or deal is completed. Owners put a great deal of energy into working towards an exit and the momentum continues well into the weeks, months and even years post exit. It’s important to acknowledge and prepare for this stage. Focus will move to reviewing those life and family goals that may have been key drivers behind the exit.

Talk to an Expert

To find out more about how The MGroup Corporate Finance team can help support your exit strategy, please contact Partner Geoff Pinder. Contact Geoff for a confidential discussion via email g.pinder@themgroup.co.uk or call 07717 874 357. Further information and guidance on how to plan for a successful exit can be found here.